A Message From Equifax:

New Mortgage Inquiry Process Starts September 14, 2020

• Starting September 14, 2020 Equifax will be requiring ALL lenders to have an identifying Member Number in order to continue to receive files from brokers.

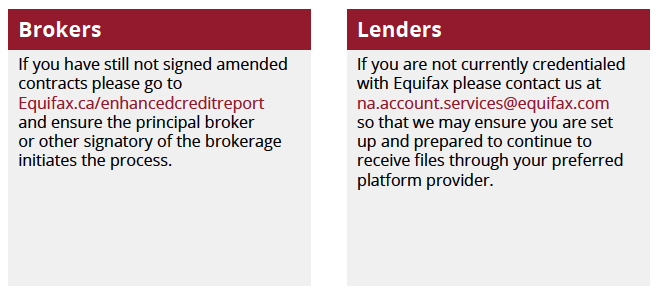

• Only brokers who have signed amended contracts will be able to obtain credit files through industry connector platforms.

• Each and every inquiry will be posted with both broker and lending institution name via all industry connector platforms and only credentialed lenders will gain access to these files.

If you have not done so already, action is required to ensure there is no impact to your business. The following steps need to be taken:

Why are the changes being made?

As a committed leader in compliance and security in this industry, where a potential problem or risk is flagged, Equifax must act and work collaboratively to correct it. Over the years, the industry has undergone many changes designed to provide greater safeguarding and oversight to protect consumers. It is increasingly important for all of us to do whatever we can to protect consumers and mitigate any potential risks, especially in light of the rising incidence of data breaches and the use of peoples’ information for nefarious purposes.

How are the changes expected to impact stakeholders?

The change we are making within the mortgage ecosystem to ensure that ALL credit file inquiries are posted is for the primary benefit of consumers. Providing a full and accurate picture of the persons and entities which have legal access to their information will strengthen consumer trust in the industry as well as enhance a consumer’s ability to monitor the potential misuse of data.

Lenders will benefit from participating in a system that captures ALL consumer file activity and inquiries leading to improved insights and analytics. Data accuracy leads to better credit decisions, greater understanding of consumer behaviours, which in turn leads

to better account management. Our goal is ensure all lenders have the ability to view sensitive consumer credit file information and are officially registered as members of Equifax and maintain an Equifax member number in good standing.

Brokers will also benefit from having access to additional data that may help them better understand their client’s credit history. An Enhanced Broker Credit Report is being launched to help brokers and lenders gain deeper insights on mortgage applicants and help improve information accuracy. Our goal is to ensure all brokers have access to this enhanced report and are able to share files with credentialed lenders only.

Credit file providers, portal partners and IT integrators are helping Equifax implement the important process changes to ensure compliance.

We are highlighting the need for brokers to adhere to their contract agreements that sharing is limited to credentialed lenders only, this includes private lenders and mortgage investment corporations, who must have an EFX member number to receive a consumer’s credit file and score.